In May of 2022, Broadcom announced its $61 billion acquisition (and $8 billion of debt) of VMware in hopes to cash in on a now mature virtualization software market. To date, the deal has been slow-moving (as expected with any deal this size), due to needed approvals from the US, the UK, and the EU.

However, now as of August 2023 and a week away from the annual VMware Explore (aka VMworld) event, the approval hoops have all but been jumped through with UK and EU giving conditional approvals last month and most other countries also giving the nod. The US FTC is a final hurdle but current statements from Broadcom point at an October 2023 close timing with their fiscal calendar.

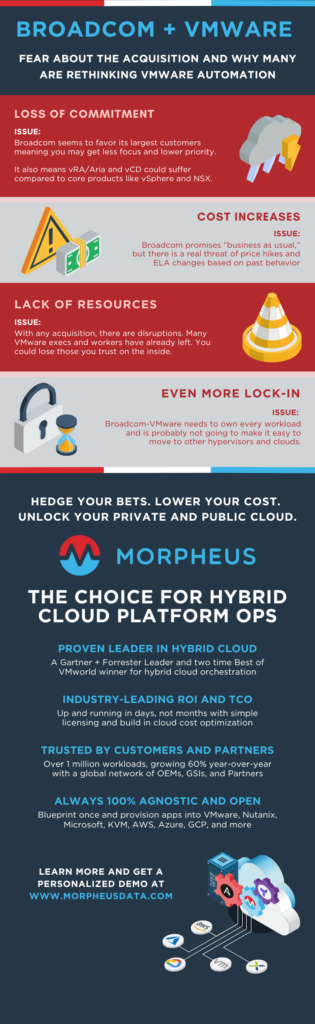

The biggest questions at the forefront of everyone’s minds, from customers to partners to employees of VMware? Will Broadcom follow through on their promise of business as usual, or will the speculation about focus on core hypervisor tech and price changes come to fruition?

The concerns at hand

Broadcom is acquisition-happy, having acquired 35 companies in its tenure as a company looking to broaden its offerings and turn maturing companies into cash cows. Some of their biggest acquisitions include CA Technologies (an IT management and software solutions company) and Symantec (a security heavyweight). Once acquired, Broadcom has integrated the tech, streamlined go-to-market, and designed for free cash flow.

This sounds straightforward, but if past experience is a predictor of future behavior; their biggest customers have maintained the upper hand in shaping direction while the masses seem to be left wading through changing product roadmaps, increasing prices, and fluctuations in staffing as workforce reductions inevitably occur. Long-time business and technology analyst Dave Vellente of Wikibon wrote what I think is still one of the best analyses of the initial Broadcom VMware news.

VMware Employees express concern about potential layoffs. Since the announcement of the acquisition last year, the company has seen a lot of key people leave. Will Broadcom mimic past mergers and shave off staff including in engineering and support? Time will tell but many of the best and brightest have already jumped to the next thing leaving the remainder to jockey for position in the new world order.

VMware Customers face the possible loss of commitment and, of course, cost increases. VMware prides itself on customer relationships, but once Broadcom takes over, these relationships may change for the worse if you arent a Global 500 company. And will Broadcom accelerate transition to subscriptions for VMware along with bloated software suites to milk the brand even further? Established jewels like vSphere and NSX are likely to get plenty of love while smaller lines such as Aria, Carbon Black, and Tanzu may fight for priority, leaving customers wanting.

For many long-term VMware advocates, this has been a wake-up moment to think about hedging their bets more so than a wholesale hypervisor swap-out. Core products like vSphere are too entrenched for a hypervisor alternative to completely take over but interest in abstraction layers like Morpheus have increased so customers and partners can choose to provision into other hypervisors and clouds as easily as they can into VMware.

Acting fast: other vendors are responding

Other private cloud offerings are preparing for an onslaught of customers looking to move or reassess their private clouds, and even public clouds like IBM are looking into offering hybrid options. Increasing complications are occurring with cloud-native software dev practices, which is making it far more likely that organizations will deploy more resources in more places. This can create more management difficulties, and no one wants to intentionally do that.

Gartner cites software players like Nutanix, Red Hat, Rancher, and Oracle as among the competitive solutions to VMware private cloud. Great News: Morpheus integrates with all of these and in fact, many of these vendors are actively developing their own Morpheus cloud plugins to respond to increasing demand for alternatives.

OEM hardware vendors such as HPE, Dell, and Lenovo also see this sea change as a windfall opportunity. 20-ish years ago VMware came on the scene and took control of compute workloads, leaving hardware players to fight over commoditized compute, storage, and networking infrastructure. With the Broadcom-VMware news, these OEM players now have a chance to take back control and offer customers fully managed and hypervisor-agnostic alternative private cloud solutions. Great News: They all partner and integrate with Morpheus to provide agnostic private and hybrid cloud.

Morpheus is here to help you through the uncertainty

With Gartner urging dont assume business as usual and recommending caution, VMware customers have to keep their options open and hedge their bets. With the possibilities of loss of commitment and resources and product cost hikes, the potential for re-platforming has never sounded more logical. Sound like a lot of work? It doesnt have to be with Morpheus, the leading hybrid cloud management platform on the market with 1 million VMs under management across hundreds of enterprise customers.

One of the core NIST attributes of a private or public cloud is the ability to provision workloads through a self-service interface. This simple, and well governed, provisioning experience is what Morpheus delivers as easily into VMware as with other hypervisors and the public cloud including integration of networks, storage, ITSM, config. management and other technologies.

Morpheus was built by DevOps pros for inevitabilities like this; the cloud world is changing quickly with the needs of enterprises. Being able to effectively consume infrastructure across private and public cloud without being locked into any provider is not just possible, its easier than ever with Morpheus.

The deal is likely to go through, but only (more) time will tell

A lot of promises are being made by Broadcom with this acquisition, and, historically speaking, we should all practice vigilance and hope for the best. But hope is not a strategy, you have time to hedge your bets and look into re-platforming with the help and support of Morpheus so you can turn your VMware into the private cloud it should be while also giving yourself plenty of outs should the need arise.

Ready to learn more? Request a Morpheus demo to experience the future of hybrid cloud platform operations yourself.

Were even offering special incentives to get you started in 2023 complete with install, integration, training, and initial cloud instances along with bursting through the end of the year (yes there are some caveats but lets talk).